To import or export goods from a non-EU country , you must always have them cleared through customs. Certain formalities, guidelines and restrictions must be observed. At Dörrenhaus, we are always there for youso that you don't make any mistakes or forget anything during the whole process, allowing you to concentrate on your core business. This way, you avoid losses and practise good resource management.

Customs regulations for the import of goods

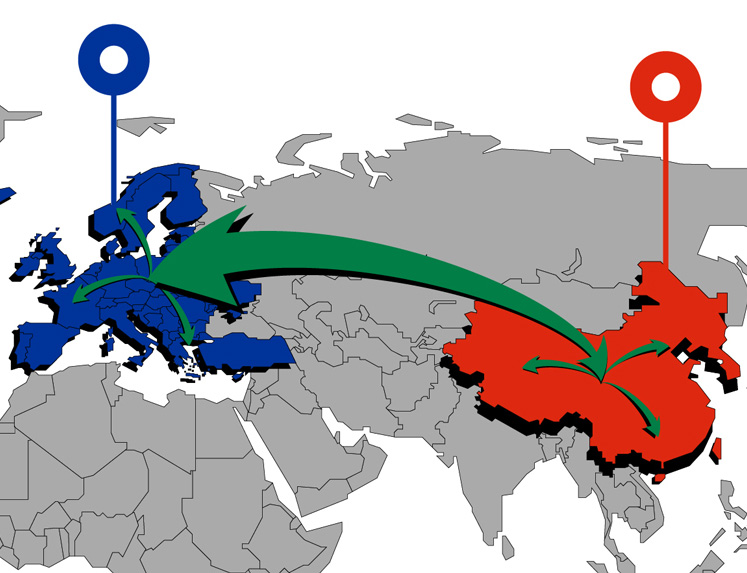

Goods cannot always be imported into Germany from non-EU countries such as the USA, Russia, Japan or China. Certain restrictions or bans apply to certain countries, goods or persons. The payment of taxes or customs duties can also occur when importing goods from a non-EU country. In order to import your goods in accordance with the regulations, you must also declare them in advance for a specific customs procedure.

There are various options available for you. We at Dörrenhaus will help you choose the right procedure and take care of all the formalities for you. Sit back, relax and leave your customs clearance in our capable hands.

Requirements for import from a non-EU country

Goods cannot always be imported into Germany from non-EU countries such as the USA, Russia, Japan or China. Certain restrictions or bansapply to certain countries, goods or persons. The payment of taxes or customs duties can also occur when importing goods from a non-EU country. So that you can import your goods in accordance with the regulations, you must also declare them in advance for a specific customs procedure.

There are various options available for you. We at Dörrenhaus will help youchoose the right procedure and take care of all the formalities for you. Sit back, relax and leave your customs clearance in our capable hands..

Customs regulations for the export of goods

You want to export goods to a non-EU country such as Japan, Russia or the USA? Then you need to observe a number of regulations and formalities, which may lead to restrictions and tax charges. In general, not all goods can be exported from Germany due to economic, environmental or health regulations . Accordingly, certain prohibitions are to be expected. If there are no restrictions, you must still have your goods exported via a specific customs procedure.

Requirements for export to a non-EU country

Please note when exporting

- Observe prohibitions and restrictions:

There are certain bans or restrictions for certain product groups or countries. These must be taken into account in advance. - If necessary, pay customs duties in the country of destination:

In the case of customs exports to a non-EU country, the goods are transferred to an export procedure.

Among other things, export duty, VAT and/or excise duty may be charged. - Receive favourable customs treatment in the country of destination:

You need an EORI number (Economic Operator Registration and Identification number) for your customs clearance. - Register to be cleared goods for export::

Enquire about the various export procedures at a customs agency or the relevant customs office.